In the digital age, where the allure of online shopping carts is just a click away, savvy consumers are constantly seeking ways to maximize their purchasing power. Among the plethora of strategies available, cashback credit cards have emerged as a favorite tool for turning everyday expenses into rewarding experiences. These cards not only offer a seamless way to earn money back on purchases but also provide a sense of financial empowerment. In this article, we delve into the world of cashback credit cards, exploring the best options tailored for online shopping enthusiasts. Whether you’re a seasoned bargain hunter or a casual browser, discover how these financial instruments can enhance your shopping experience, making every digital transaction a step towards smarter spending.

Maximize Your Savings with Top Cashback Cards

When it comes to online shopping, choosing the right cashback card can make a world of difference in how much you save. These cards offer enticing rewards that not only put money back in your pocket but also enhance your shopping experience. Whether you’re a frequent online shopper or just looking to make the most out of your occasional purchases, there’s a card tailored for your needs. Here are some features to look for when selecting a cashback card:

- High Cashback Rates: Look for cards that offer elevated cashback percentages on online purchases, which can significantly boost your savings.

- No Annual Fee: Opt for cards that don’t charge an annual fee, ensuring that your rewards aren’t offset by additional costs.

- Bonus Categories: Some cards provide higher cashback in specific categories like groceries, dining, or travel, which can be beneficial if these align with your spending habits.

- Introductory Offers: Many cards come with introductory bonuses, such as extra cashback for the first few months or upon reaching a spending threshold.

Choosing the right card can lead to substantial savings and make your online shopping more rewarding. Explore your options, compare the features, and pick a card that aligns with your spending patterns for maximum benefit.

Unveiling the Perks: Cashback Programs Explained

In the world of online shopping, cashback programs have become an enticing incentive, allowing consumers to earn a percentage of their spending back on eligible purchases. These programs offer a range of benefits that can enhance your shopping experience, transforming routine transactions into rewarding opportunities. With the right credit card, you can unlock a plethora of perks, making every click and checkout more financially beneficial.

- Instant Savings: Cashback programs provide immediate rewards on purchases, allowing you to save money on the spot.

- Versatile Redemption Options: Accumulated cashback can often be redeemed for statement credits, gift cards, or even deposited directly into your bank account.

- Enhanced Budget Management: By receiving cashback on your spending, you can effectively reduce your overall expenses, making it easier to stick to your budget.

- Exclusive Offers: Many cards offer additional cashback on specific categories or during promotional periods, giving you the chance to maximize your earnings.

Whether you are a frequent online shopper or someone who occasionally indulges in digital retail therapy, choosing the right card can significantly impact your financial strategy. Embrace the advantages of cashback programs and watch your savings grow with each online transaction.

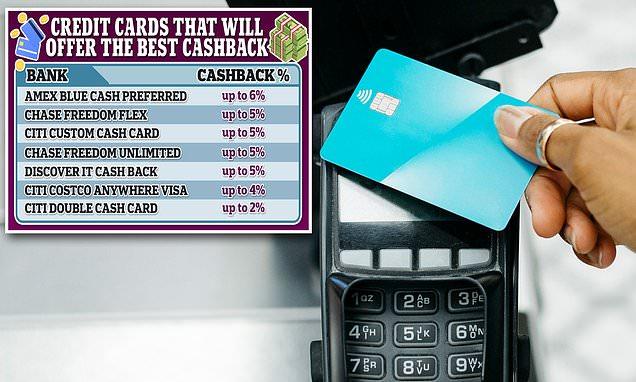

Expert Picks: Cards That Offer the Best Online Rewards

When it comes to maximizing your online shopping rewards, choosing the right card can make all the difference. With a plethora of options available, we’ve curated a list of standout cards that offer exceptional cashback benefits. These cards not only enhance your shopping experience but also ensure that every purchase contributes to your savings.

- Card A: Renowned for its robust rewards program, Card A offers a generous 5% cashback on all online purchases. Its user-friendly app provides seamless tracking of rewards and exclusive access to online shopping events.

- Card B: This card stands out with its tiered cashback structure, offering up to 3% cashback on online transactions. With added perks like free shipping credits and extended warranties, Card B is a versatile option for avid online shoppers.

- Card C: Perfect for those who prefer simplicity, Card C delivers a flat-rate 2% cashback on every online purchase, making it easy to accumulate rewards without worrying about spending categories.

Strategic Spending: Tailor Your Card Choice to Your Shopping Habits

In the ever-evolving landscape of online shopping, finding the right credit card can feel like discovering a hidden gem. Your shopping habits are as unique as your fingerprint, and tailoring your card choice to match them is a strategic move that can lead to substantial rewards. Whether you’re an occasional buyer or a digital shopaholic, identifying the card that complements your spending style can enhance your cashback benefits.

- Frequent Online Purchasers: For those who find themselves clicking “Add to Cart” more often than not, a card offering high cashback rates on general online purchases can be invaluable.

- Retail Loyalty: If you have a favorite e-commerce platform, consider a card that partners with that retailer for exclusive cashback offers.

- Category-Specific Spenders: Cards that offer rotating categories might be your best bet if your online purchases tend to focus on specific areas, like electronics or fashion.

By aligning your card selection with your online spending patterns, you not only maximize your rewards but also make every purchase a step towards smarter financial management. In the world of digital shopping, your card choice can be as strategic as your shopping list.